Law Firm Cost Cutting Led to Greater Profitability in 2020, But That’s Not a Sustainable Business Development Strategy

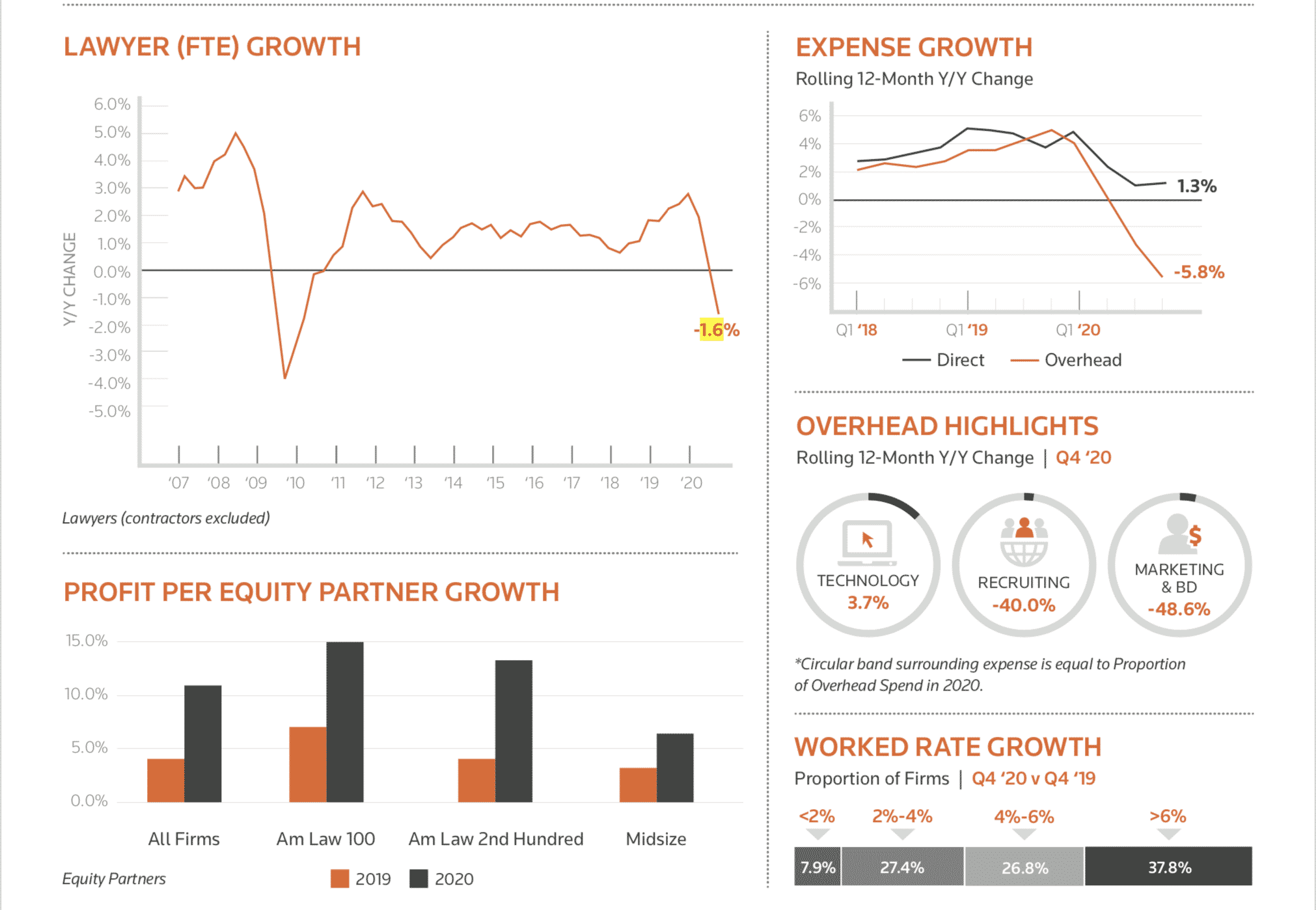

Thomson Reuters’ Peer Monitor Index, issued earlier this month, draws attention to the root of the strong profit growth with which law firms ended a turbulent year. With some practice areas, including corporate and tax work (as well as bankruptcy) experiencing around 4% growth or more, reduced demand in areas like litigation was partially offset. But those practice areas that continued to thrive despite or because of the downturn did not account for the rise in profits. The determining factor was decreased expenses.

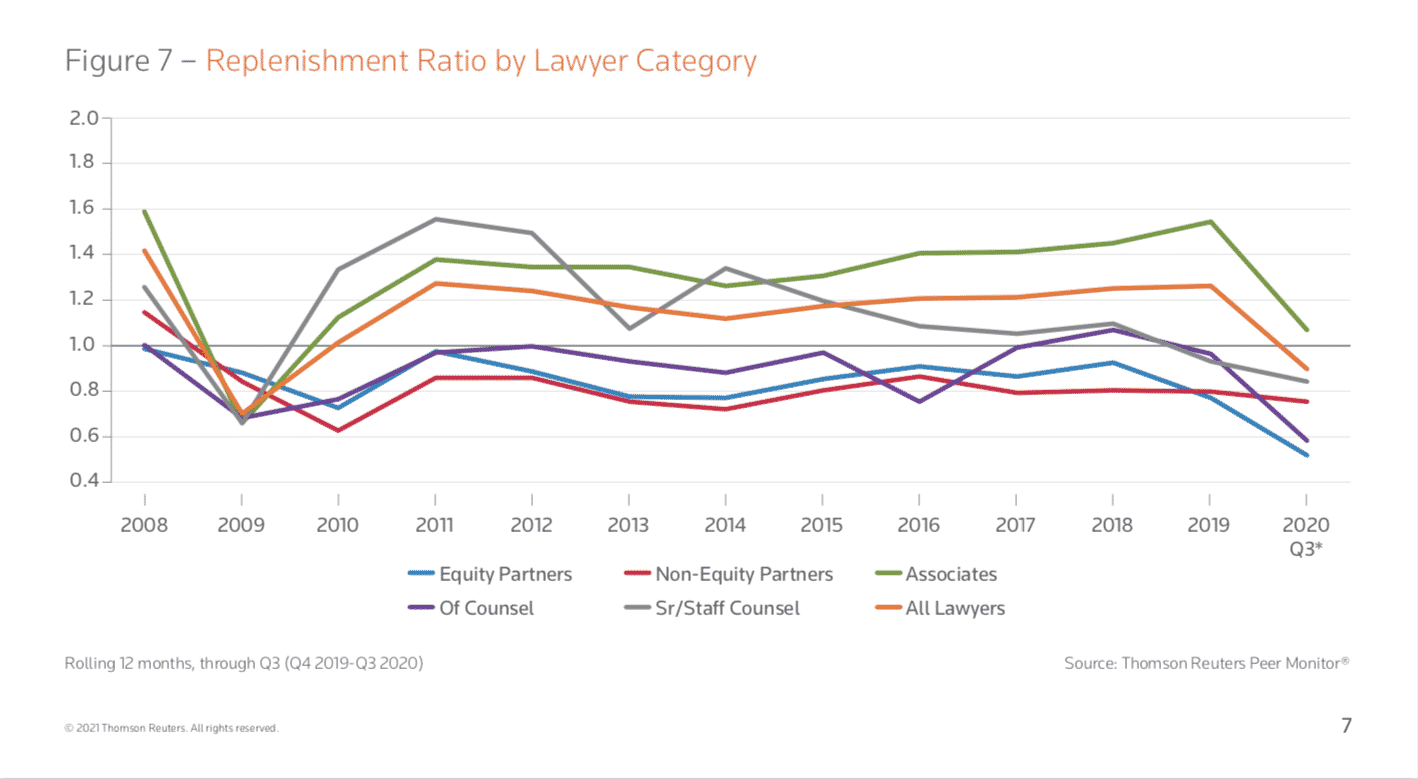

In response to the rise of the pandemic, firms were quick to reduce staff sizes, especially when a work-from-home model made it more difficult for administrative personnel to communicate and coordinate with attorneys. Going into the second half of 2020, lawyers began to be hit by layoffs as well. Thomson Reuters notes a 1.6% reduction in attorneys, mostly at the associate level, which is comparable to lawyer job loss during the great recession.

Without conference fees, travel expenses, and other costs associated with entertaining clients, it’s unsurprising that firms could easily create a short-term dip in expenses. Overhead costs related to office space, on the other hand, might decrease on a permanent basis as firms choose to adopt partial-remote models that allow for fewer lawyers in the office at any given time.

As demand grows, firms will rebuild their ranks, and the bottom line is that cutting costs can only go so far toward increasing profits. For law firms and individual attorneys determined to not just weather the storm but continue expanding, the real triumphs will come from building their books of business. Reducing expenses may have resulted in favorable profits per equity partner last year, but it won’t carry firms forward. Each firm’s ability to bring in new clients, grow in additional practice areas and specializations, and maintain its position in the market will be the truer test.

Leave a Reply

Want to join the discussion?Feel free to contribute!